ETH Price Prediction: Technical Strength Meets Fundamental Catalysts

#ETH

- Technical indicators show ETH trading above key moving averages with Bollinger Band support

- Upcoming Fusaka upgrade and MetaMask token launch provide fundamental catalysts

- Whale profit-taking and Fed policy decisions represent near-term risk factors

ETH Price Prediction

ETH Technical Analysis

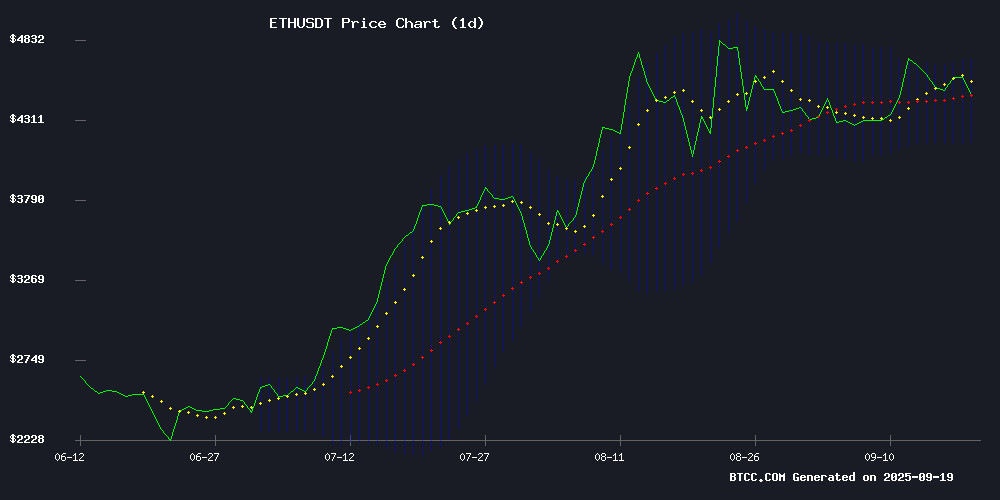

According to BTCC financial analyst Emma, Ethereum's current price of $4,522.56 sits above its 20-day moving average of $4,440.06, indicating potential bullish momentum. The MACD reading of -59.14 suggests some near-term weakness, but the price remaining within the Bollinger Bands range of $4,167.12 to $4,712.99 shows stability. Emma notes that holding above the middle band could signal continued upward movement.

Market Sentiment Analysis

BTCC financial analyst Emma observes mixed market sentiment surrounding Ethereum. While the upcoming Fusaka upgrade in December and MetaMask's token launch present positive catalysts, profit-taking by whales and Federal Reserve uncertainty create near-term headwinds. Institutional demand and layer-2 developments continue to support the long-term bullish case, according to Emma's assessment.

Factors Influencing ETH's Price

Scroll DAO Restructures Governance for Enhanced Efficiency

Ethereum's Layer-2 scaling project Scroll has unveiled a restructuring of its DAO governance model, emphasizing swifter alignment with market dynamics. The Scroll Foundation will retain strategic oversight while delegating daily operations to an Execution Council. Treasury management shifts to annual or semi-annual budget cycles, with protocol security assurances unchanged.

Governance Council applications will open imminently alongside a revised DAO constitution. The move reflects growing sophistication in decentralized governance frameworks as Layer-2 ecosystems mature.

Ethereum Faces Crossroads as Whales Take Profits Amid Fed Rate Cut Rally

Ethereum surged past $4,600 following the Federal Reserve's 25 basis point rate cut, mirroring broader crypto market optimism. The second-largest cryptocurrency now tests critical resistance levels while whales capitalize on profits reminiscent of November 2021's peak.

Mid-tier holders controlling 10,000-100,000 ETH have begun offloading positions, with one entity liquidating 5,000 ETH for a $22.84 million profit. This selling pressure coincides with surprising outflows from spot Ethereum ETFs, which saw $1.89 million exit despite favorable macroeconomic conditions.

Technical indicators suggest a make-or-break moment near the $4,640-$4,700 resistance zone. Failure to breach this level could trigger a correction toward $4,000, though the establishment of a solid base above $4,420 maintains bullish potential. Market participants watch whether institutional demand can offset whale distributions in this high-stakes equilibrium.

Ethereum Announces Fusaka Update for December 3 Launch

Ethereum's core developers have set December 3 as the mainnet deployment date for the Fusaka upgrade, following testnet activations on Holesky (October 1), Sepolia (October 14), and Hoodi (October 28). The update marks a significant leap in scalability with Peer Data Availability Sampling—a breakthrough allowing validators to verify large data blobs in fragments rather than full downloads, slashing network congestion.

Gas limits will quintuple from 30 million to 150 million units per block, while Verkle Trees optimization slashes proof sizes. Notably, blob capacity doubles within two weeks post-upgrade, potentially accelerating Ethereum's dominance in smart contract platforms. Market watchers anticipate bullish momentum for ETH as institutional validators prepare infrastructure adjustments.

Ethereum’s Fusaka Upgrade Set for December Mainnet Launch

Ethereum developers have finalized the rollout timeline for the Fusaka upgrade during the ACDC 165 call. The scalability-focused update will debut on the Holesky testnet October 1, followed by staggered deployments on Sepolia (October 14) and Hoodi (October 28) before reaching mainnet December 3.

The upgrade introduces a phased expansion of blob capacity, incrementally increasing from 6/9 to 10/15 in the first week before reaching 14/21 in the second week. This tiered approach aims to optimize network performance while minimizing disruption.

MetaMask to Launch Its Token Sooner Than Expected, Says ConsenSys CEO

MetaMask, the leading Web3 wallet, is accelerating plans to launch its native token. ConsenSys CEO Joe Lubin confirmed the timeline may surprise market observers, signaling a strategic shift in the project's tokenomics approach.

The potential MASK token would integrate directly into MetaMask's interface, leveraging its 30 million monthly active users. Regulatory clarity appears to be driving the expedited timeline, with co-founder Dan Finlay noting favorable conditions for token launches.

Token functionality could include governance rights and user incentives, creating new utility layers for the Ethereum-based wallet. Market analysts anticipate significant distribution advantages given MetaMask's position as the dominant gateway to DeFi applications.

Ethereum Whales Accumulate Amid Diverging Market Views

Ethereum whales have aggressively expanded their holdings, adding 820 ETH worth approximately $3.8 billion over 72 hours. Wallets holding 10k-100k ETH now control 31 million coins, signaling strong institutional demand. This buying spree coincides with growing anticipation for spot ETH ETF approvals.

Market sentiment remains divided. While on-chain metrics suggest accumulation, analyst Benjamin Cowen warns of an impending correction. His historical analysis predicts altcoins will underperform Bitcoin until November, with ETH potentially retesting the 21-week EMA. "The real altseason hasn't begun," Cowen cautions, even as ETH tests resistance at $4,772.

The tug-of-war between whale accumulation and technical warnings creates market uncertainty. Ethereum's ability to sustain prices above $4,772 will determine whether it invalidates midterm bearish forecasts. Institutional inflows from ETF issuers continue to provide fundamental support against technical headwinds.

Ethereum Price Prediction Hinges on Federal Reserve Rate Decision

Market participants are closely monitoring the upcoming Federal Reserve meeting, as its outcome could significantly influence Ethereum's price trajectory. Historically, ETH has demonstrated sensitivity to shifts in monetary policy, with dovish signals typically catalyzing rallies in risk assets. The current Ethereum price prediction debate centers on whether Fed action will break ETH out of its prolonged consolidation.

Ethereum's fundamentals remain robust despite macroeconomic uncertainties. The network continues to dominate smart contract activity, with staking mechanisms and institutional ETF interest creating structural demand. Past cycles show ETH price movements correlate strongly with liquidity conditions - surging during quantitative easing periods and retracting during tightening cycles.

The Fed's impending decision creates bifurcated scenarios for Ethereum. A rate cut could trigger capital flows into ETH and other crypto assets, while maintaining restrictive policy might prolong the current trading range. Market makers appear positioned for volatility, with derivatives activity increasing ahead of the announcement.

Water150 Launches Blockchain-Backed Spring Water Project with Historic Satra Brunn Well

Water150, a blockchain-based ecosystem developed by the Longhouse Foundation, has unveiled its inaugural natural water source—the historic Satra Brunn well in Sweden. This 324-year-old spring, renowned for its premium mineral water, will secure 66 million liters annually starting in 2027, each liter backed by a Water150 token issued on Ethereum.

The project leverages blockchain transparency to guarantee sustainable access to high-quality spring water for 150 years. Satra Brunn serves as the benchmark for future water sources added to the network, with its 18th-century pedigree ensuring reliability. Longhouse Water S.A., a Luxembourg entity, oversees the tokenization, linking physical reserves to digital assets.

By anchoring real-world resources to blockchain technology, Water150 pioneers a model where hydration becomes a traceable, tradable commodity. The initial 66 million tokens mirror the well’s annual capacity, merging centuries-old natural infrastructure with decentralized finance.

Ethereum Price Prediction: Institutional Demand and Layer-2 Alternatives Fuel Bullish Outlook

Ethereum's price trajectory is drawing intense scrutiny as analysts project a potential surge to $6,593 by December 2025. Network upgrades, Layer-2 scalability breakthroughs, and accelerating DeFi adoption are fueling this optimism. The altcoin currently consolidates near $4,670, with technical models suggesting a near-term target of $5,407.

Institutional interest remains robust—spot ETH ETFs attracted $1.4 billion in August alone. Resistance at $4,800-$5,000 could pivot into parabolic momentum if breached, supported by growing TVL and on-chain activity. Meanwhile, early backers of utility-driven Ethereum projects have seen returns exceeding 400%, highlighting the asymmetric potential of strategic positioning before retail adoption peaks.

A new Layer-2 Ethereum alternative emerges as a dark horse for 2025 gains, though regulatory scrutiny in the U.S. and EU looms as a potential headwind. The $120 million outflow from Binance signals shifting capital allocations within the ecosystem.

Is ETH a good investment?

Based on current technical indicators and fundamental developments, ETH presents a compelling investment opportunity. The price trading above key moving averages combined with upcoming network upgrades and institutional interest suggests strong potential. However, investors should monitor whale activity and Fed decisions closely.

| Metric | Value | Signal |

|---|---|---|

| Current Price | $4,522.56 | Neutral |

| 20-Day MA | $4,440.06 | Bullish |

| Bollinger Position | Upper Band | Strong |

| MACD | -59.14 | Caution |